Impact 30: New faces in the upper echelons of impact

New Private Markets

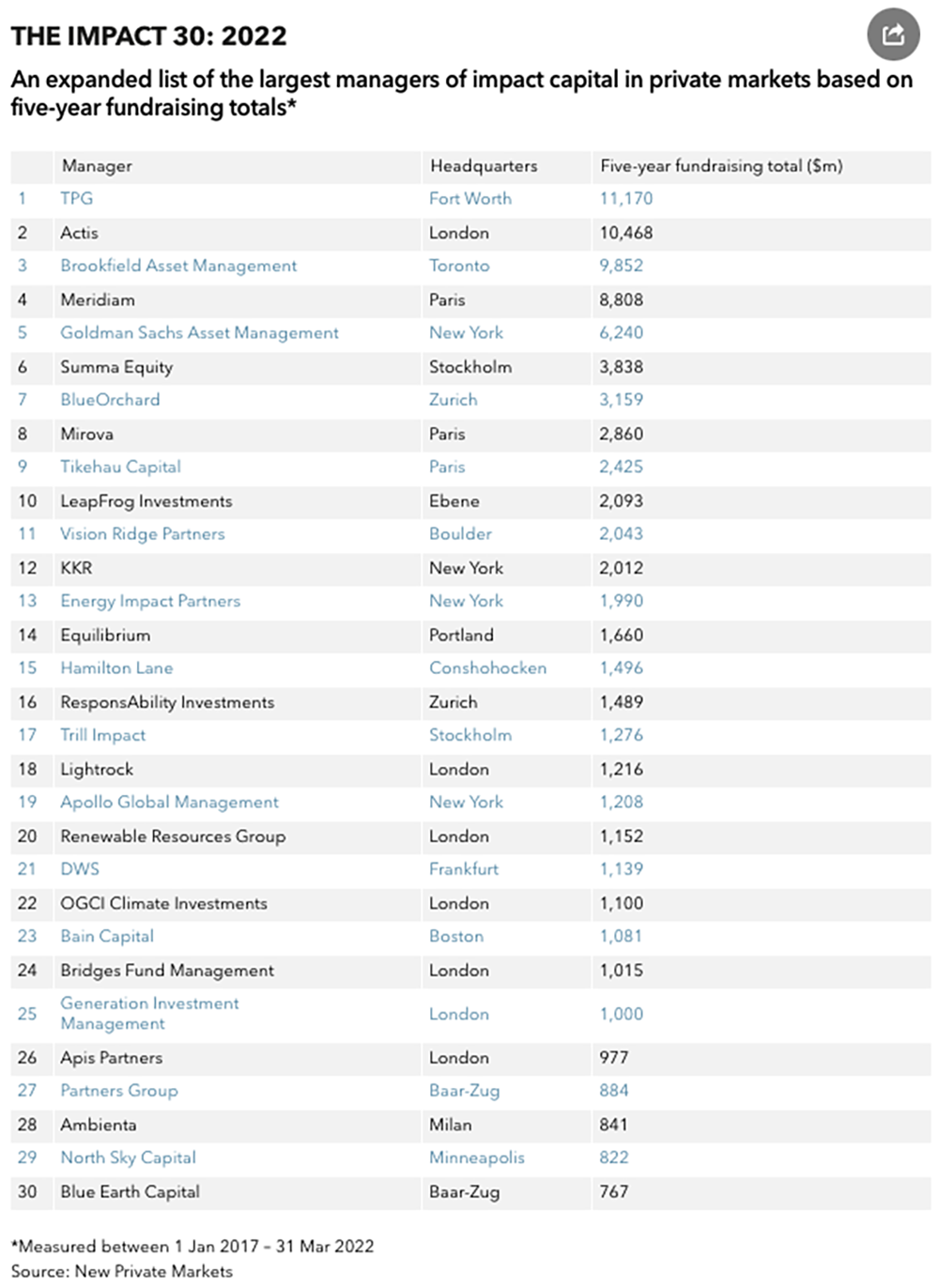

TPG is crowned the largest manager of private markets impact capital in this year’s edition of the Impact 30, while nine new names are added to the expanded list.

There has been a reshuffling and expansion of our ranking of the world’s largest managers of private markets impact capital, with TPG edging out Actis to be crowned the world’s largest.

The ranking measures the amount of impact-focused private markets capital raised by managers over a five-year period. The objective is to give the best possible view of the managers who – at this moment – have the most capital and influence in the market.

Change at the top

Actis, the sustainable infrastructure investor with roots in development finance, has been knocked off the top spot by TPG, an early mover among mega-firms in the impact space. TPG’s ascent to the top was primarily driven by the final close it held in March on its $7 billion Rise Climate Fund. On an earnings call in May, Jim Coulter, TPG founding partner and lead on the strategy, said that the firm had been “pleasantly surprised” by both the scale of demand from investors for the product and the opportunity for deployment. The firm is also in market with the third generation of its generalist impact family, for which it is targeting $3 billion, although this does not factor in its Impact 30 total, as it had yet to close on any capital during the counting period.

Another private markets giant, Brookfield Asset Management, is being propelled up the ranking by a climate strategy. The Brookfield Global Transition Fund has now held a record-breaking final close on $15 billion. However, as of the end of March, the cut-off time for this edition of the ranking, the firm had closed on just shy of $10 billion, putting it in third place.

As the impact investment universe has expanded, so too has our list, from a top 20 to a top 30. Since we last calculated the ranking in November 2021, we welcomed nine new names on to the list.

New arrivals

The largest of the new arrivals is Goldman Sachs Asset Management at number five on the list. Among various smaller strategies and separate managed accounts, the firm is raising its first climate-focused impact fund, Horizon Environment and Climate Solutions, which has so far secured more than $1.2 billion according to our data. In a roundtable event in May this year, Michael Bruun, European head of private equity for GSAM, dismissed the idea that there was too much money chasing too few climate investments: “In certain areas, I don’t think there is enough risk capital; that’s where governments need to step in and help clarify the pathway for people to make an appropriate investment return.”

BlueOrchard, the impact investment firm owned by Schroders, has a long history in impact investing, having been established in 2001. It has a broad geographical reach encompassing emerging and growth markets across the world and pursues impact themes through private debt, private equity, infrastructure and blended finance. It recently launched its second private equity vehicle, the BlueOrchard Financial Inclusion Fund, with a target of $300 million. It enters our list at number seven.

Mirova, a sustainability-focused asset manager and B-Corp, is also included in our list for the first time. The Paris-headquartered firm, which is a portfolio company of fund management group Natixis IM, is currently raising its fifth-generation renewables fund, relabelled as Energy Transition Fund 5. It is breaking interesting ground elsewhere in its product range, with multiple vehicles dedicated to natural capital and an Environment Acceleration Capital fund: essentially a growth equity private equity vehicle for environmentally positive businesses, for which the firm has introduced an impact-linked carry element.

Industrial influence

One of the nuances of private markets impact investing is the unconventional LP base it attracts. Alongside the familiar fund investors who participate purely for the risk-adjusted return (endowments, pension funds, insurers, etc) and the development finance investors seeking to stimulate growth, one increasingly finds corporates with a strategic interest. This latter group has propelled Energy Impact Partners to number 13 on our list, with a five-year fundraising total just shy of $2 billion.

The firm has a growing family of funds backed primarily by a wide group of large utility, energy and industrial companies. In January this year it closed a $200 million Deep Decarobonization Fund to invest in early-stage climate tech, complementing its larger, later stage vehicles. EIP operates a model in which industrial LPs, which constitute the majority of its investor base, are involved in the assessment of nascent technology and products. These LPs provide early feedback on whether they would be potential users of such products.

A firm with similar industrial DNA is OGCI Climate Investments, which makes the list at number 22. OGCI raised $1.1 billion from its limited partners – which are all oil majors – in 2017 to invest in early-stage “catalytic” technology to support the transition to a low carbon economy. The firm is now preparing to launch a strategy focused on later-stage, growth equity investments, the firm’s chief executive officer told New Private Markets in July.

In at number 14 is Equilibrium, a Portland, Oregon-headquartered firm that makes sustainability-driven real assets investments two sectors: agriculture and water, waste and energy. Its biggest fund so far was the second of its Controlled Environment Food funds, which closed on just over $1 billion in 2021 to invest in high-tech indoor and greenhouse growing facilities.

Zurich-based ResponsAbility Investments is an impact investing old-timer, having been established in 2003. The firm was recently acquired by investment giant M&G Investments, as way for the latter to get a running start in ResponsAbility’s area of expertise: emerging markets impact. When M&G acquired the firm in January this year, ResponsAbility had $3.5 billion in assets under management, of which 85 percent is in private debt strategies and 15 percent in private equity strategies. It has dedicated funds for climate finance, financial inclusion and sustainable food and agriculture.

We have been anticipating Apollo Global Management‘s arrival in the list since our research team started gathering data in 2021. Apollo hired executives to launch its impact platform back in 2020 and – through its Impact Mission Fund – is seeking to differentiate itself from the impact competition by investing capital into mature businesses, such as its debut deal in Reno De Medici, a Milan-listed producer of recycled cartonboard. “When the tools and approach of impact investing are applied to larger scale businesses, Apollo believes that the potential impact is substantially greater both in aggregate and per dollar invested,” the firm states.

At number 30, Blue Earth Capital has emerged from under the wing of Partners Group. Established originally by Partners Group’s founders, the firm has changed its name from PG Impact to Blue Earth and hired private equity veteran Stephen Marquardt as CEO. The firm plans to raise a substantial amount of capital in separate accounts to invest alongside pooled funds, the firm told us in March and is currently raising its first dedicated climate strategy. “I think we’re the only impact investing firm that can offer suchglobal mandates to the clients, where clients can also steer the themes that are most important to them,” said Urs Baumann, outgoing CEO of the firm.